IDENTIFICATION.

WHO IS IT?

In a first step, a payment needs to be assigned to a specific payer once it is initiated.

The second step in the identification process in payment transactions is technically assigning to a specific account.

In a broader context, i.e. in addition to the identification process considered as part of a payment, individuals who create an account are subject to an identification obligation. This aims in particular at preventing fraud and money laundering.

IDENTIFICATION WITH

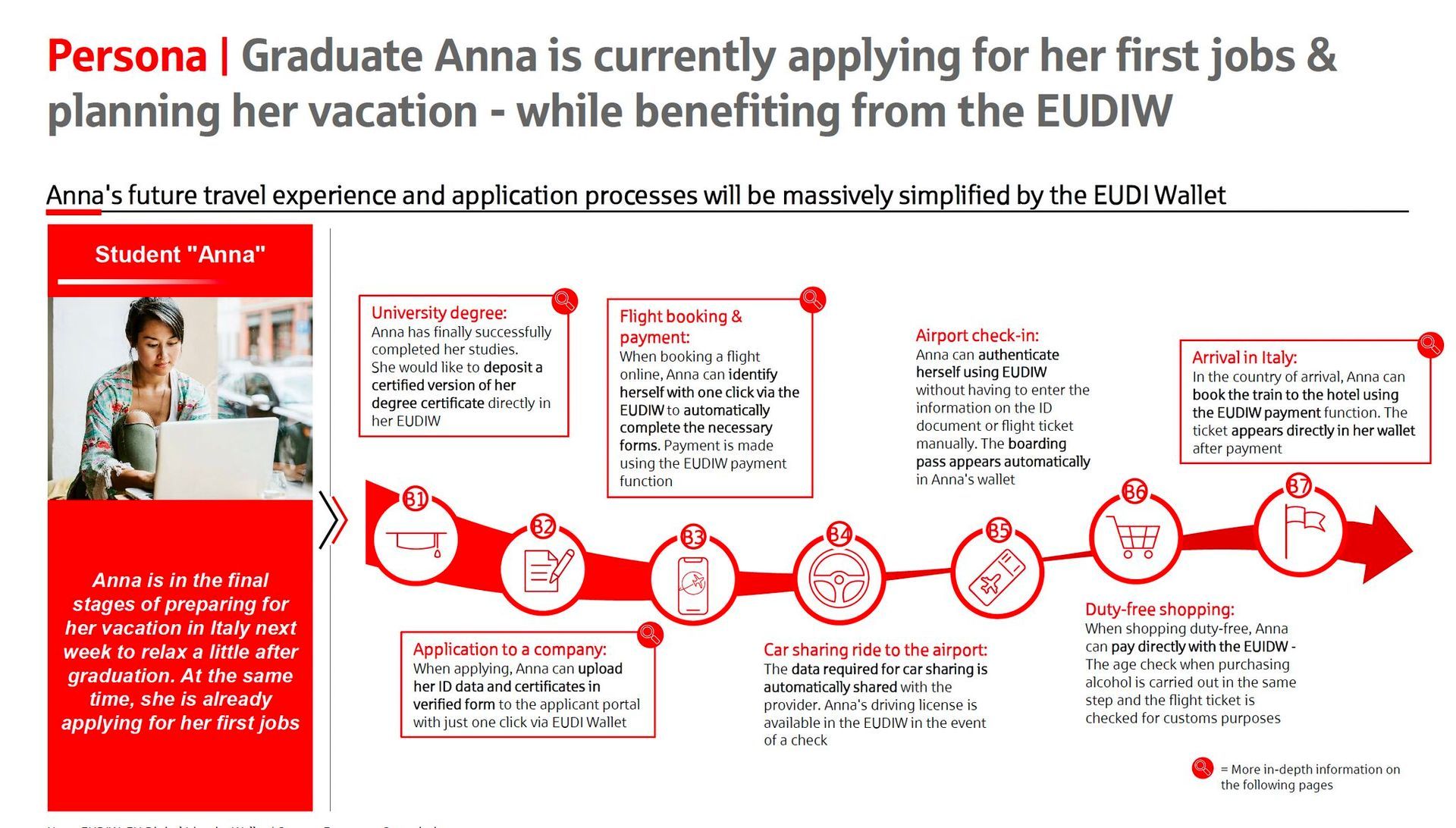

Identification can also be seen in a broader context than payments. Electronic identification is in scope of digitalization e.g. with digital wallets. This usually includes authentication. Some uses cases referring to the European digital wallet are displayed in Olivers contribution below.

Contribution of Oliver Lauer

Research by the Digitallabor of the Sparkassenfinanzgruppe

Potential use-cases of an EU Wallet

"What would you get out of it?

Probably the most important question about the success of an EU Wallet:

Will the customer use the wallet?

In the context of this question, I startet a small research series on the potential use of an EU Wallet." (Oliver Lauer on LinkedIn:

https://www.linkedin.com/in/oliverlauer/recent-activity/all/ )

The attached image focusses on a core aspect of the EU Wallet, which was also used in episodes 1-5. The #synergetic capability of the envisaged open #EUDIW architecture.

Together with the triggering of a payment, for example, an address or an age cheque could also be transmitted, thus enabling a convenient and simple fast checkout.

Of course, this feature already exists today. What is new is that #eIDAS2 will provide all players in the market with an open infrastructure for this aspect, which will then be compatible throughout Europe. At the same time, this new Digital Public Infrastructure (#DPI) is based on a standardised, high level of trust across the EU, so that it should be usable for all regulated, private and public use cases.

The attached image focusses on a core aspect of the EU Wallet, which was also used in episodes 1-6: The #synergetic capability of the envisaged open #EUDIW architecture.

Together with the triggering of a payment, for example, an address or an age cheque could also be transmitted, thus enabling a convenient and simple fast checkout.

As already emphasised in episode 6:

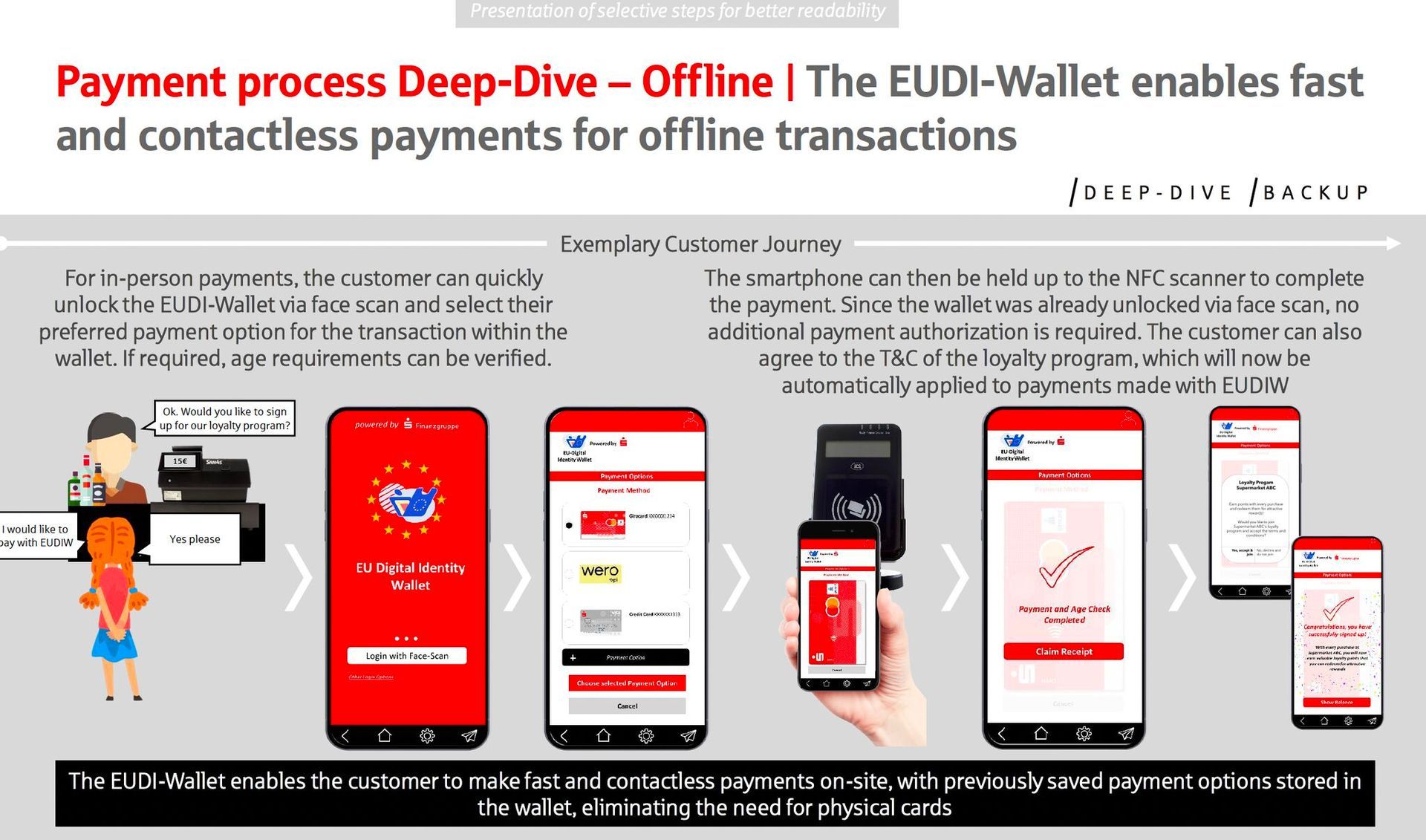

❓ What if this synegetic capability could also be used in an #offline scenario, e.g. at the #POS?

❓What if the customer could not only pay with a tap on the NFC reader, but also register and transmit the delivery address?

❓What if the customer not only pay when entering a club, but also verify the age? Comparable throughout Europe, Europe-wide?

❓Yes, what if all this could be done backed by open standard public EU-wide infrastructure? An new #dpi?